San Mateo County Market Report

January 2023 Market Report – San Mateo

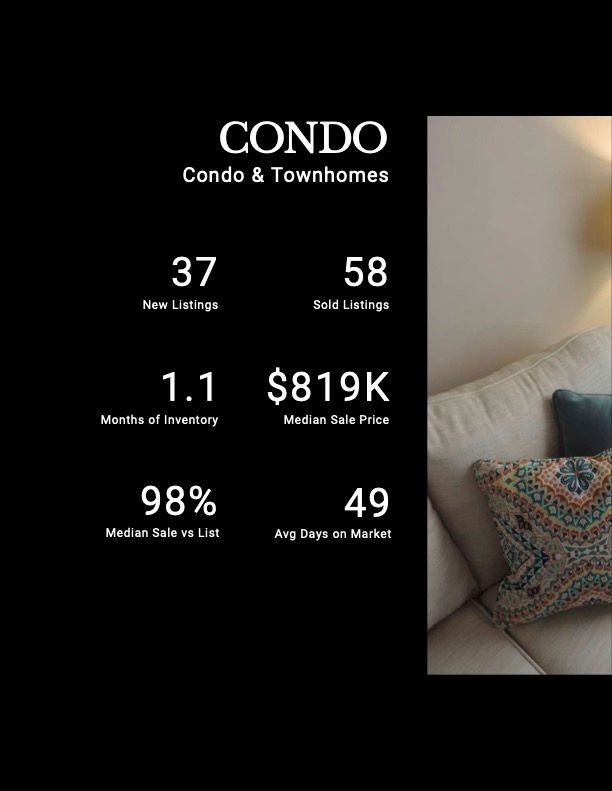

San Mateo’s single-family housing market saw a decrease to a $1.5 million median sold price. There were 238 units sold and 124 new listings. The condo & townhome market declined month-over-month with 37 new listings, and 58 sales totaling approximately $819k. Buyers have remained aggressive with average offer prices remaining at around 100%. Due to only 6% of homes being completed, the market has seen a decrease in supply. Combine these factors with the surging demand, and the cost of buying only continues being pushed up. This is creating an imbalance between the pricing range and active options in the marketplace.

Slower Wage Growth Data Boosts Bonds

The Bureau of Labor Statistics (BLS) reported that there were 223,000 jobs created in December, which was stronger than expectations of 200,000 job gains. Revisions to the data from October and November cut 28,000 jobs in those months combined. The unemployment rate declined from 3.6% to 3.5%.

JOBS: 223,000 UNEMPLOYMENT: 3.5%

What’s the bottom line? There are two reports within the Jobs Report and there is a fundamental difference between them. The Business Survey is where the headline job number comes from and it’s based predominately on modeling. The Household Survey, where the Unemployment Rate comes from, is done by actual phone calls to 60,000 homes.

The Household Survey also has a job loss or creation component, and it showed there were 717,000 job creations, which is a pretty big disparity from the headline number of 223,000 job gains. When we look deeper at the numbers, of the 717,000 job creations in the household survey, 679,000 were from part-time workers and 380,000 represent multiple job holders. This means the job creations that were reported could reflect a lot of holiday hires or people getting part-time seasonal work, making the report weaker than the headlines suggest.

MUCH OF HIRING DUE TO HOLIDAYS

In addition, average hourly earnings were up 0.3% in December and 4.6% year over year, which is down from the previous report. Average weekly earnings only rose by 0.2% last month and 3.1% year over year. Average weekly earnings measure actual take-home pay because the data factors in hours worked, which reached the lowest level since 2020. This cut in hours would actually equate to a significant number of jobs lost.

FEWER HOURS ACTUALLY WORKED

The Stock and Bond markets both reacted positively on Friday to the data on wage growth, as it reflects less wage-pressured inflation, which is what the Fed is looking for.

And the Fed was certainly watching last week’s labor market data closely, as the minutes from their December meeting showed that officials are committed to maintaining a restrictive policy stance until the incoming data provides confidence that inflation is on a sustained path to 2%. Members believe that this is likely to take some time and cautioned, based upon historical experience, against prematurely loosening monetary policy.

The information contained herein is provided solely by MBS Highway. loanDepot and MBS Highway are not affiliated in any way. Loan approval and rate is dependent upon applicant’s credit, collateral, financial history, and program availability at time of origination. Rates and terms are subject to change without notice. This is not a loan commitment or guarantee of any kind. © 2022 – loanDepot.com, LLC, 6561 Irvine Center Drive, Irvine, CA 92618. All rights reserved. NMLS #174457 (www.nmlsconsumeraccess.org) AZ: Mortgage Banker 0911092. CA: Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act CRMLA 4131040. CO: Colorado Department of Real Estate under a Mortgage Company Registration. CT: Connecticut

Department of Banking as a Mortgage Lender #ML-174457. FL: Florida Lender License number MLD903. GA: Georgia Residential Mortgage Licensee #24020. IL: Illinois Residential Mortgage Licensee #MB.6760709. MA: loanDepot is a Mortgage Lender in Massachusetts License #MC174457. MD: Licensed as a Mortgage Lender by the Commissioner of Financial Regulation #06_18928. MN: This is not an offer to enter into an interest rate lock agreement under Minnesota law. MS: Licensed by the Mississippi Department of Banking and Consumer Finance. NH: Licensed by the New Hampshire Banking Department. NJ: Licensed Mortgage Banker – NJ Department of Banking and Insurance. NY: Licensed Mortgage Banker – NYS Department of Financial Services No. 109061. OR: License # ML-4972. PA: Licensed Mortgage Lender No 31342 by the Department of Banking and Securities. RI: Rhode Island Licensed Lender. TN: under Mortgage License No. 110371; VA: mortgage lender and broker by the Virginia State Corporate Commission #MC-5431; WA: licensed by the Department of Financial Institutions under the Consumer Loan Act#CL-174457. Also licensed in: AK, AL, AR, DC, DE, HI, IA, ID, IN, KS, KY, LA, ME, MI, MO, NC, ND, NE, NM, NV, OH, OK, SC, SD, TX, UT, VT, WI, WV and WY. (010923 786371y)