September 2023 San Mateo County Market Update

State of the Economy and Our Housing Market

As 2023 moves forward, this is a good time to provide some insight on the current state of the economy for California and the United States, as well as what some factors signal about the future of our housing market. We have a couple of media clips to share, and then will break down factors like unemployment, inflation, timing the market, mortgage rates vs. home sales and home prices, and share a tale of two markets.

Economic Indicators impacting the Housing Market

Alan Ratner, managing director of Zelman and Associates, joins ‘Squawk on the Street’ to discuss the housing market, the ‘velvet’ handcuffs of low mortgage rates, and more. There are really four key indicators he mentions.

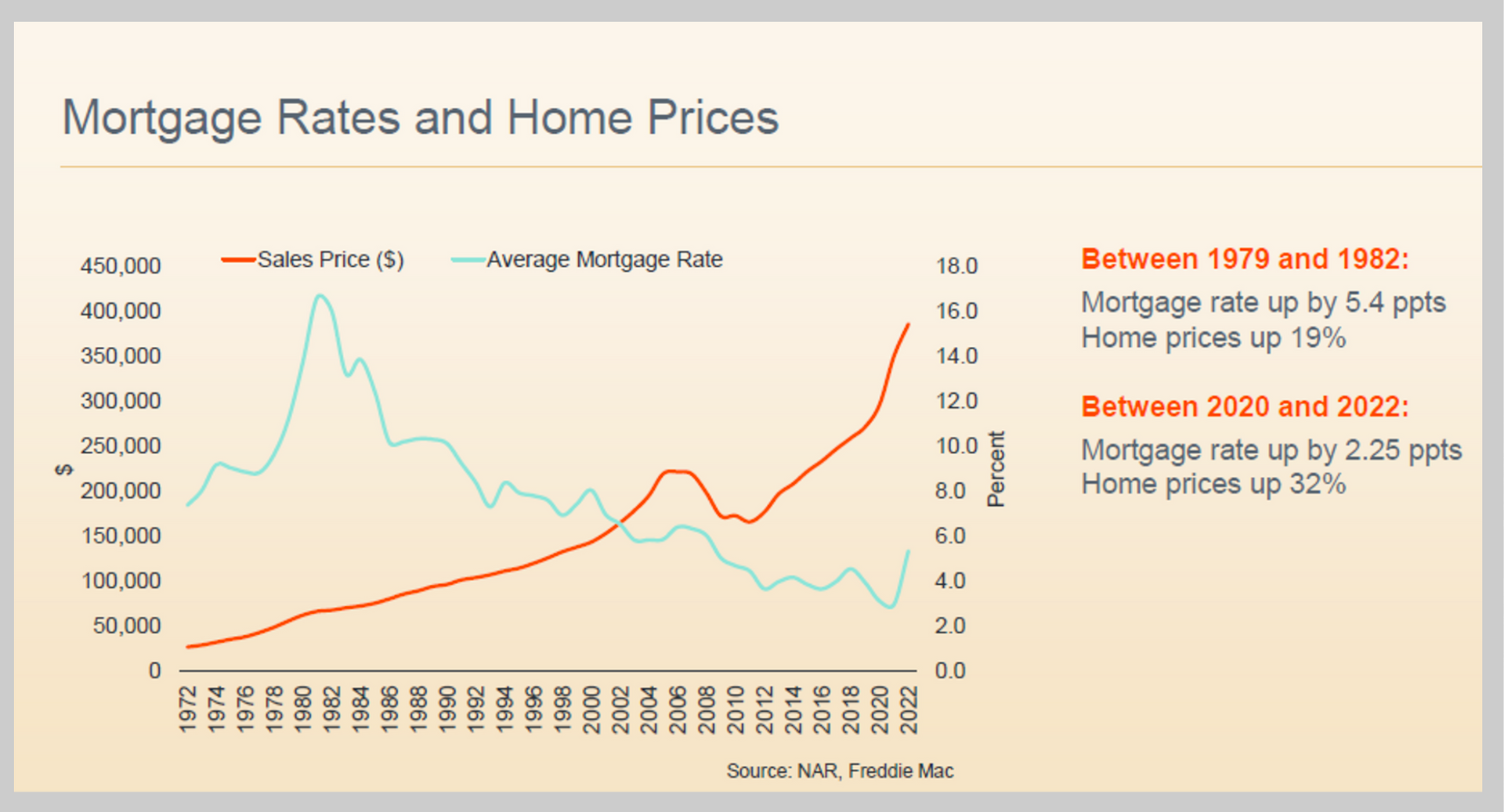

First, there was a stronger than expected start to new home market, while re-sell/existing home market is frozen with low inventory and low transaction volumes. This is keeping the housing market a bit suppressed. There was a lot of anticipation there might be a big correction on home prices, but the tight inventory mitigated that – though currently low activity is keeping a cap on the market despite record low inventory and high demand. Second, while interest rates being lower would free up the market, there are other factors like job performance and overall economy strength that could mean that doesn’t really help. Lower interest rates aren’t the end-all-be-all. Third, he talks about the decrease of rental prices and the dynamic between renting and buying. While rent growth has slowed it hasn’t really declined, but given the lack of inventory, it’s keeping rents stable. Fourth, the pricing of materials for new construction has come down from the high 1-2 years ago and coming into the year made home builders optimistic, but generally speaking the cost has been sticky with labor costs high. There is a lot of new home construction activity, and demand is still high but transactions are low, so this is going to either force builder profit margins down or home prices up.

Where are rates headed? Will there be a crash?

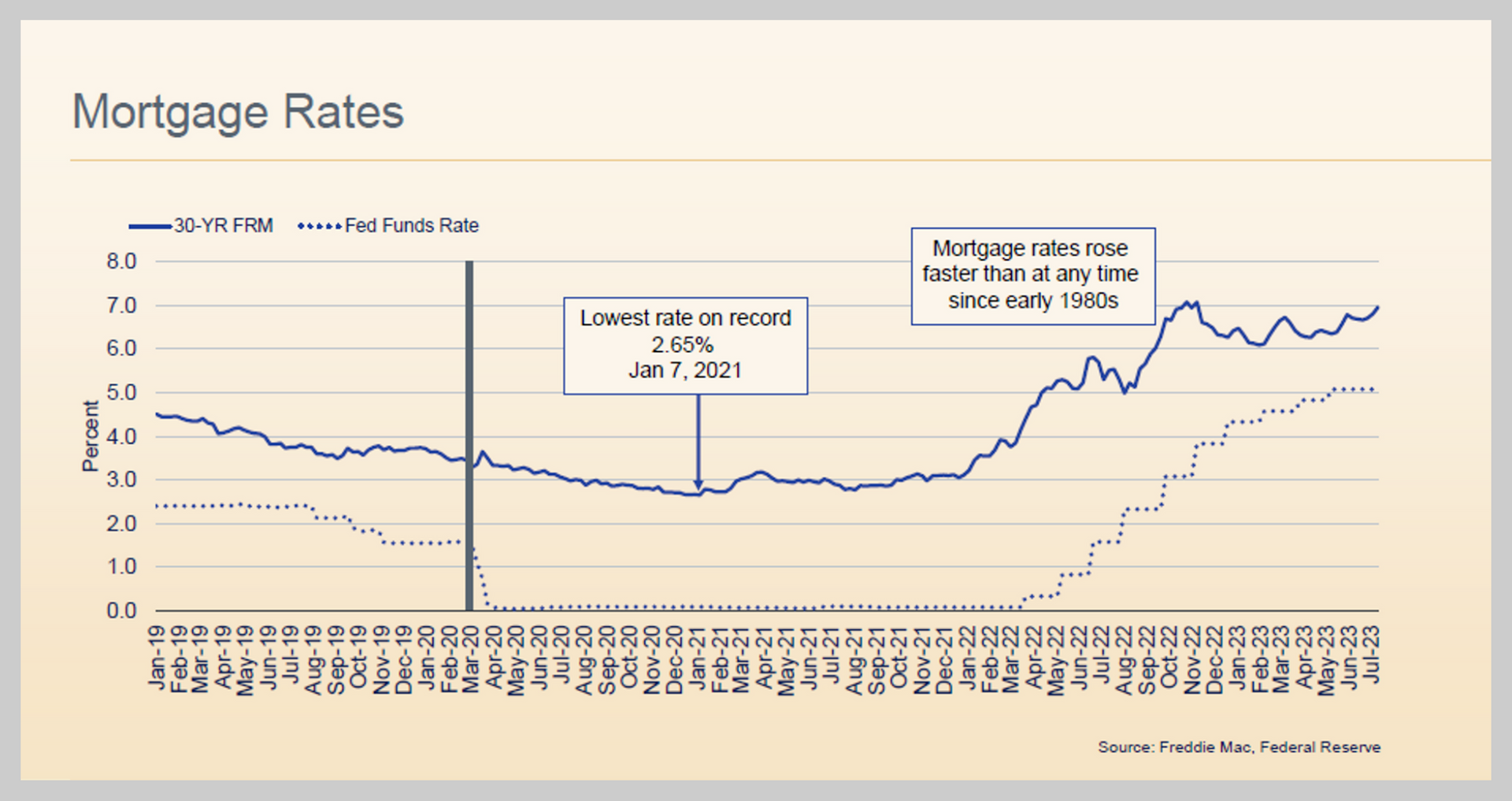

Logan Mohtashami, HousingWire lead analyst, joins ‘Squawk Box’ to discuss skyrocketing mortgage rates, after the National Association of Realtors warned rates could hit 8% if the economy continues to show strength and the Fed hikes rates again, the impact on the housing industry, and more.

Mohtashami discussed how when mortgage rates tipped over 6%, our market really came to a grinding slow down. Presently, consumers are dealing with high home prices and high mortgage rates. Mohtashami is forecasting interest rates reaching up to 8%, but don’t expect a crash because of the velocity of the market.

Key Economic Indicators

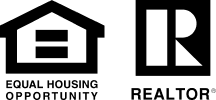

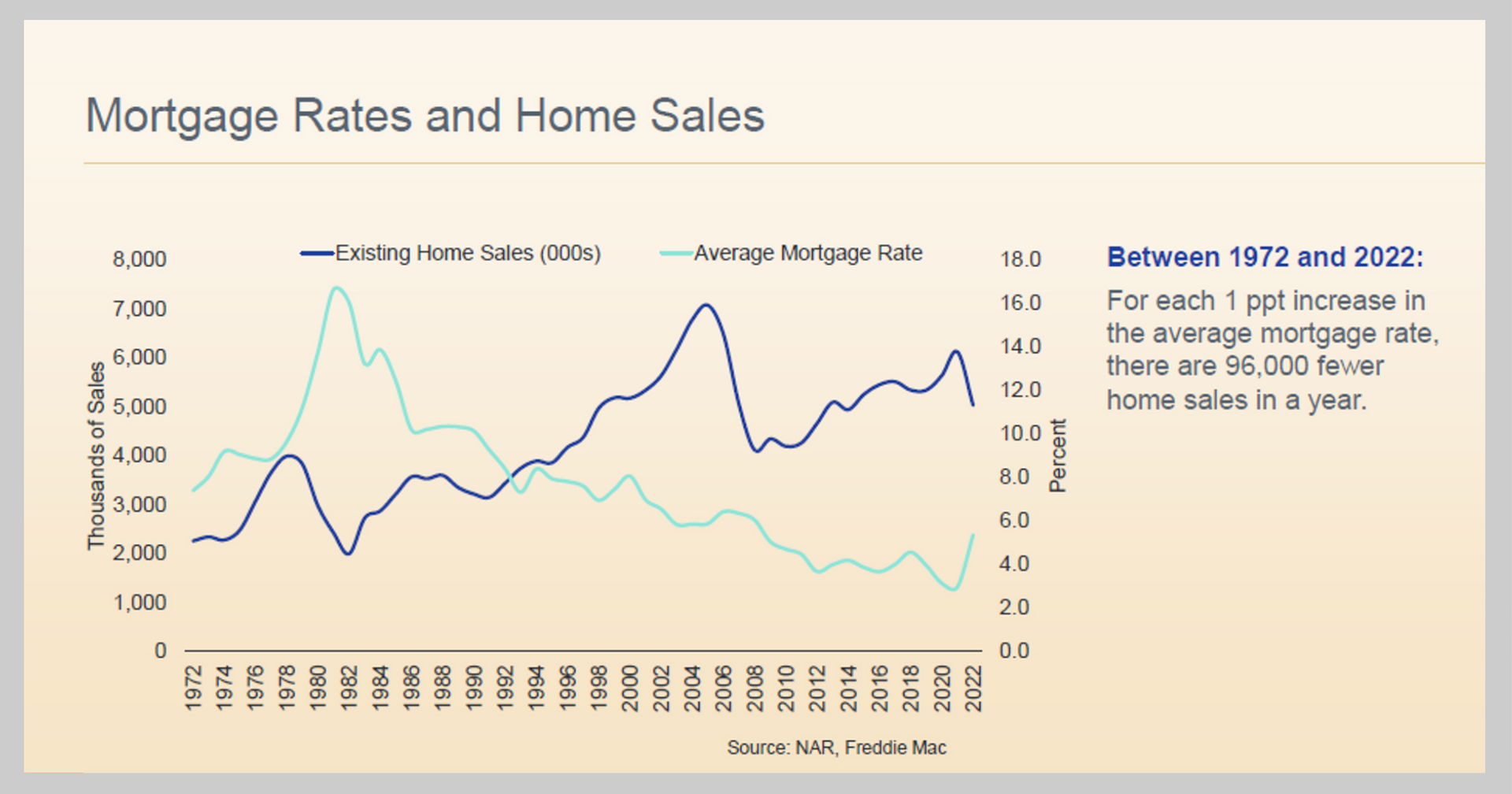

Home sales are down month-over-month from 2022. There was anticipation of a correction on home prices, but tight inventory mitigated that. Presently, low activity and high interest rates are keeping a cap on the market despite record low inventory and steady demand.

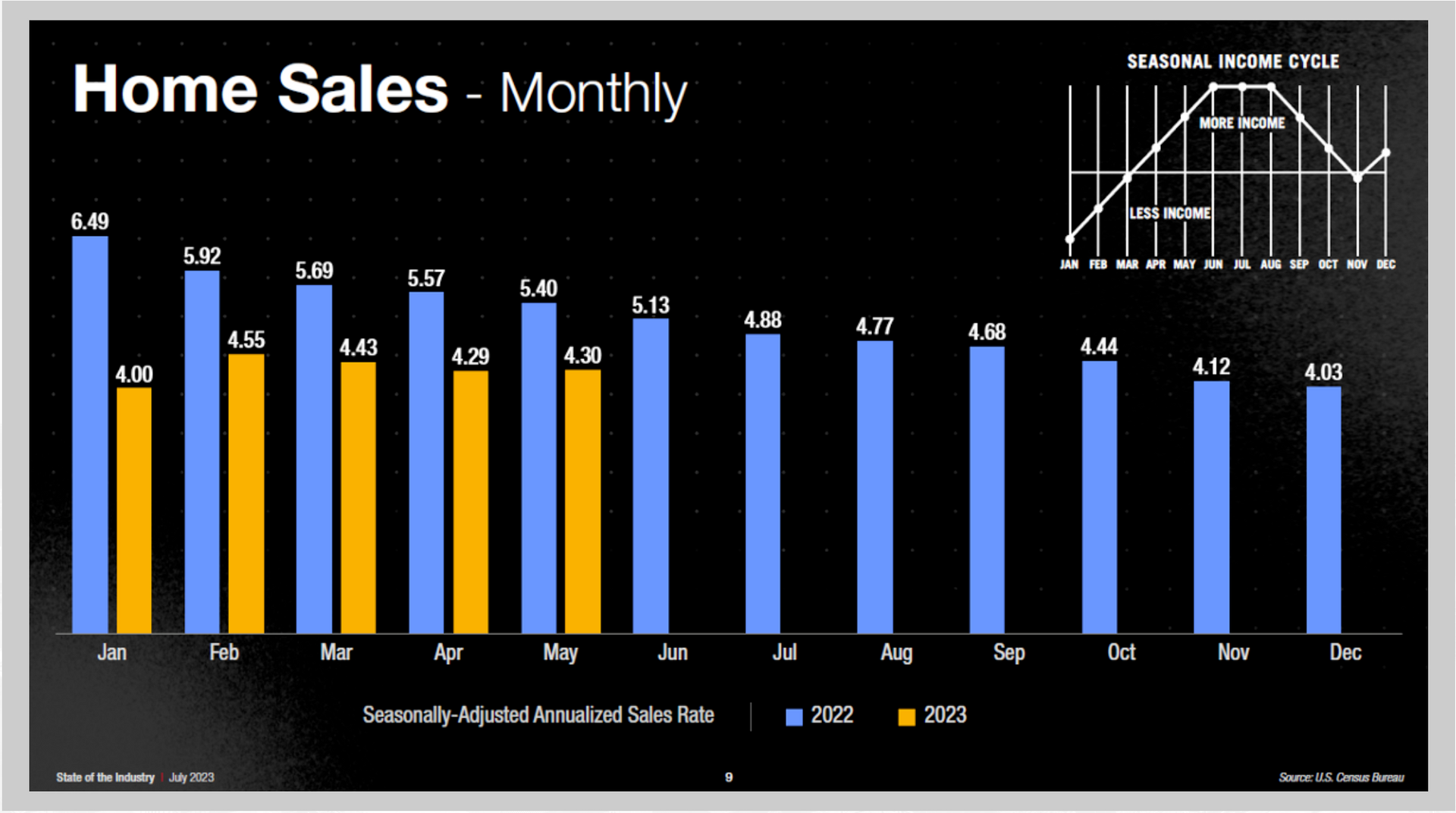

We’re almost at full employment! The employment numbers haven’t gone up to keep up with the growth rate. As long as employment stays strong, and wages grow, the housing market could see more activity.

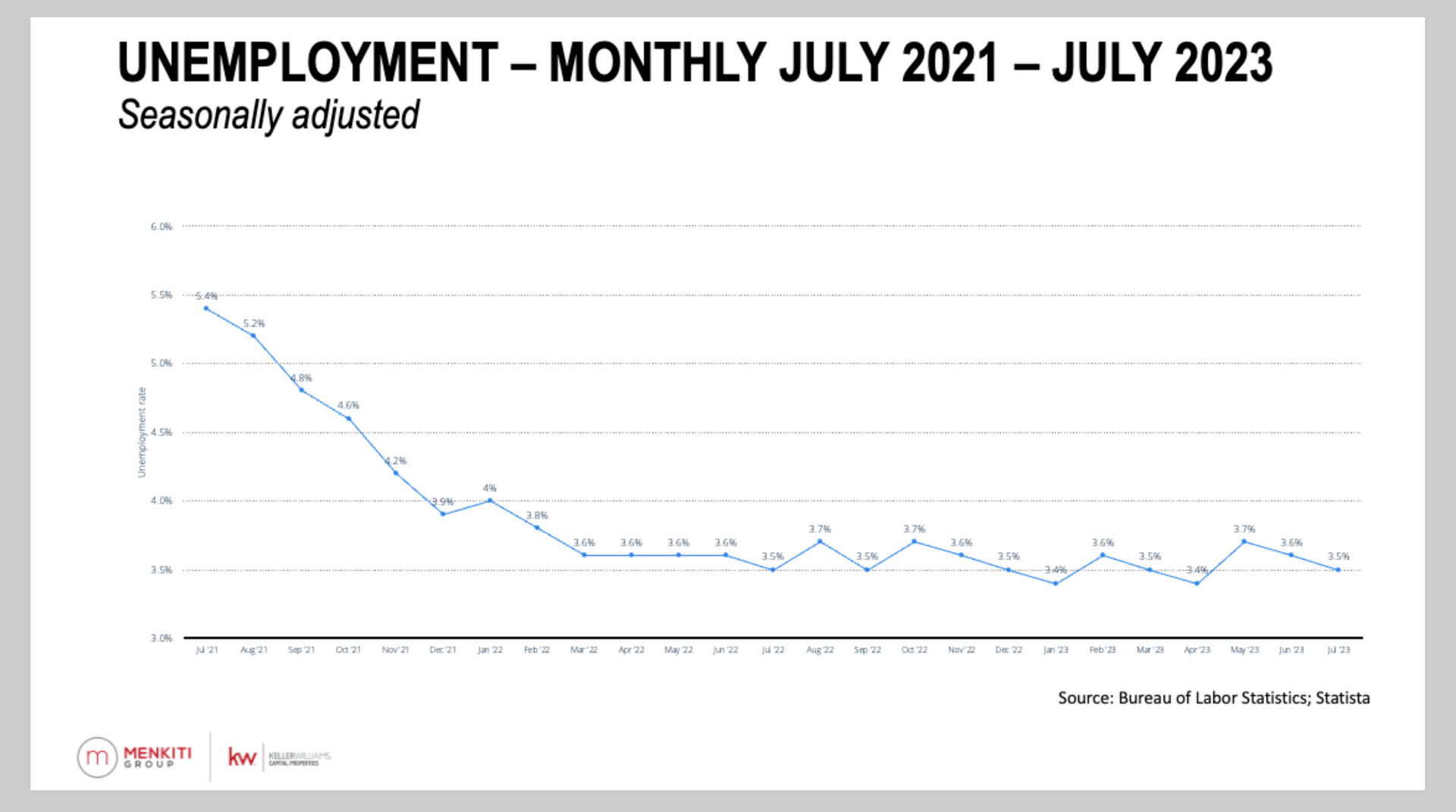

It’s been a year since there was the Inflation Reduction Act (IRA), and ideally we want to be at 2% Inflation. While we’re heading there, and all the market indicators are strong, we’re not there yet. We expect to see continued applied pressure to drive down inflation further, which means mortgage rates staying high, possibly even being pushed higher.

Housing prices will not plummet, There’s a major supply issue and very low home building, it’s all too low. It may become more stagnant, but there won’t be a plummet.

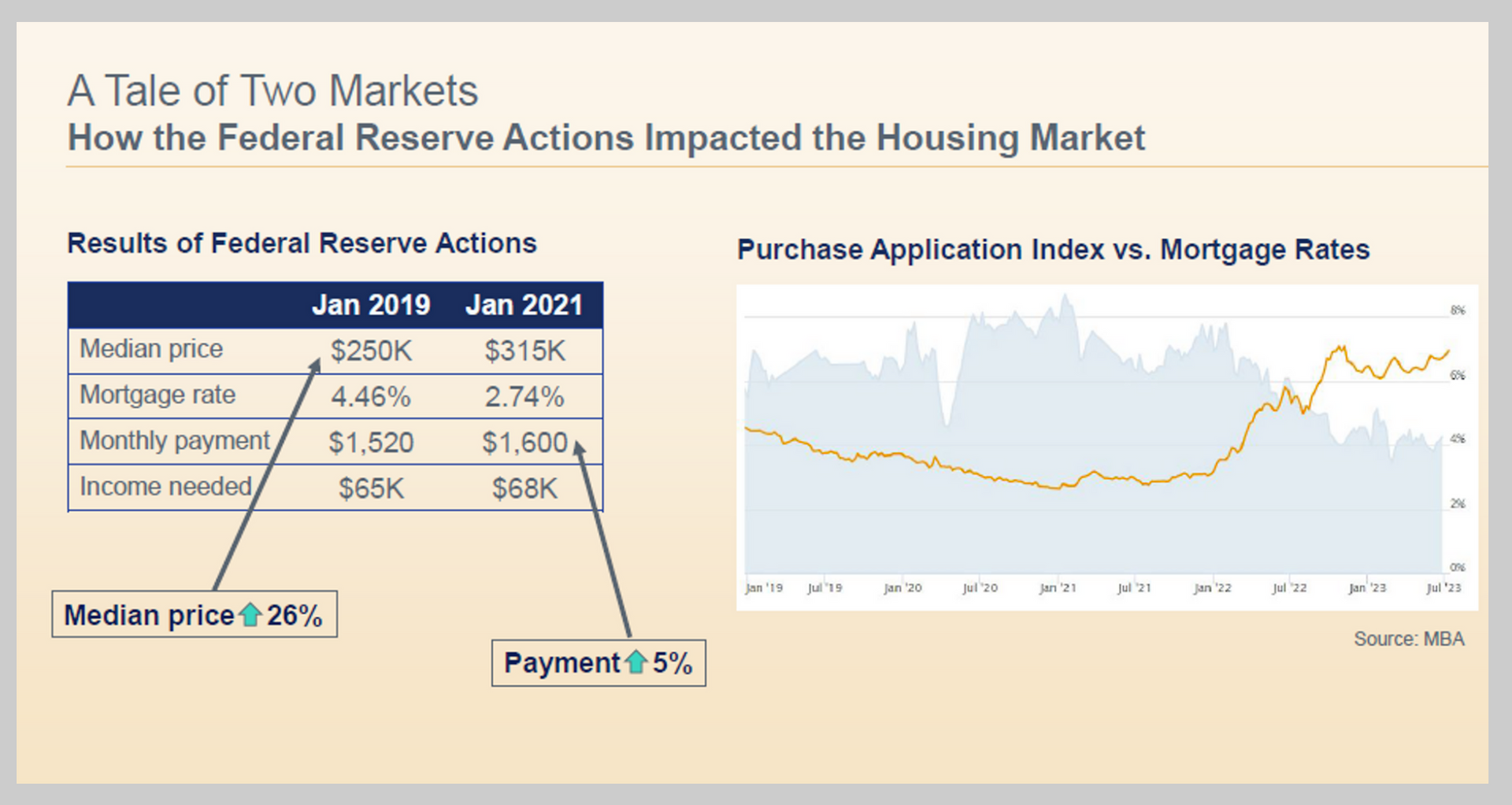

A Tale of Two Markets

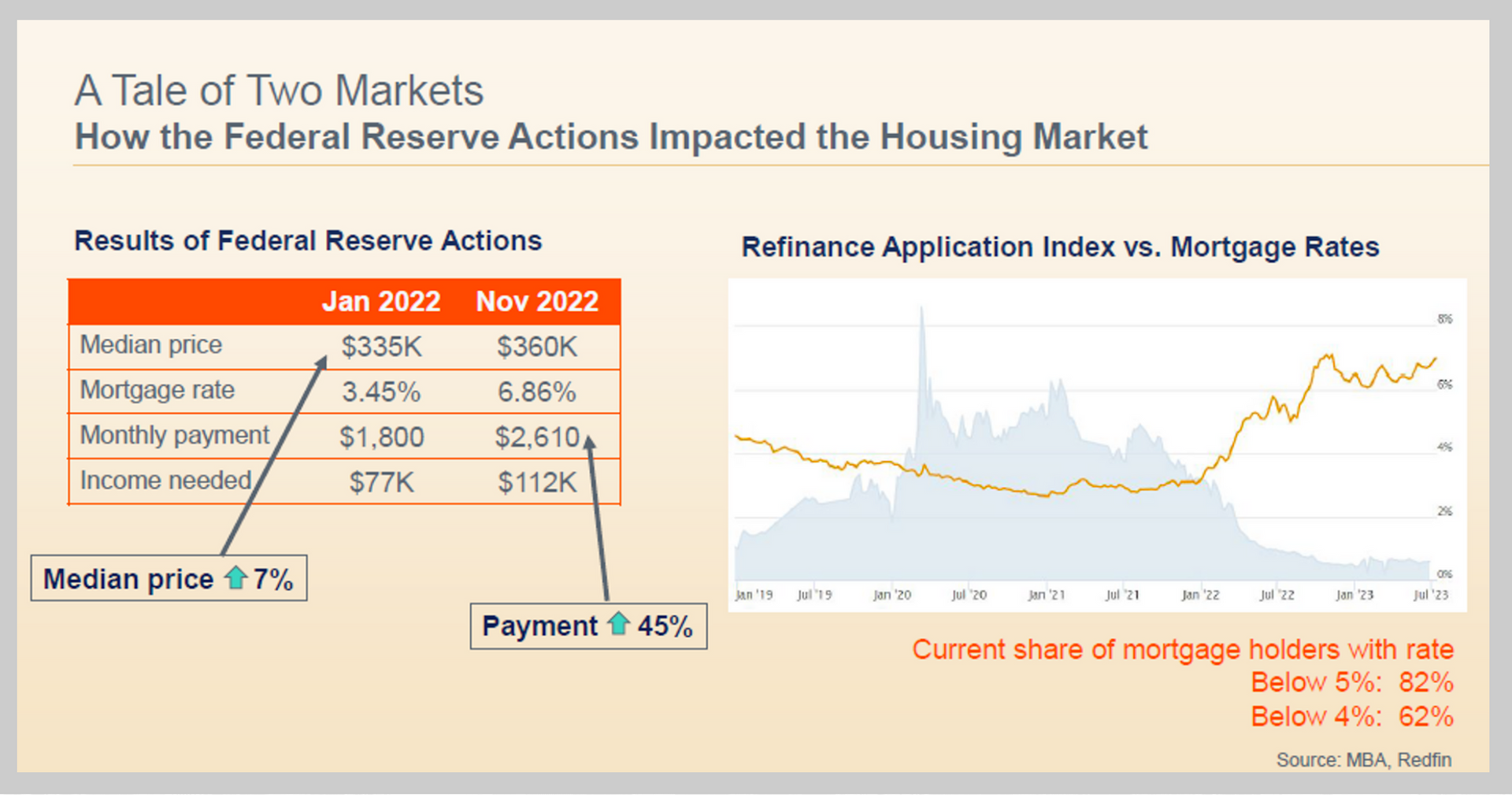

In 2019, California was in a sluggish market with increased interest rates. The graphs below shows the effect of an interest rate rise. While home values increased 7%, the payments needed to fund the loan increased 45%. Additionally, many lenders now want to see appreciating income!

This is buying power reduced, and illustrated how much rates have impacted affordability in California with high housing prices and these boom and bust cycles.

In the bottom of each graph you can see indicated that most outstanding mortgagees (~80%) currently have a mortgage interest rate below 5%, and many more (~60%) have rates even below 4%. These homeowners velvet handcuffs and most are likely unwilling to “sell to buy” because they will have a much higher mortgage for their new home.

My advice: Don’t try to time the market

We see this a lot with buyers waiting on interest rates to decline and inventory to increase, or maybe waiting on the full trifecta: housing prices falling, too. This is a dangerous game if you actually want to purchase and invest in the housing market. You’re likely to miss good inventory, current rates, and also equity being built in a home (which in our market averages ~6-8% y/o/y).

Where can you find additional financial support? There are products such as VA and FHA loans that are available to balance some of these factors, but they’re not being leveraged. Additionally, more traditional lenders are telling us about unique products and scenarios they’re handing. Some lenders are able to lock your rate for a brief period, even if you’re not yet in contract on a home.

Don’t pay the cost of waiting. Instead, assess your goals and financial situation. Speak with a lender to see what you could afford, and also a financial advisor who can help you make a good decision. Of course, contact me so you can understand the market and how you can be successful. I speak with buyers who often lament, “if only I’d bought in 2009” or “if only I’d bought in early 2020.” Don’t look back to today in a few years and still not be in a home.

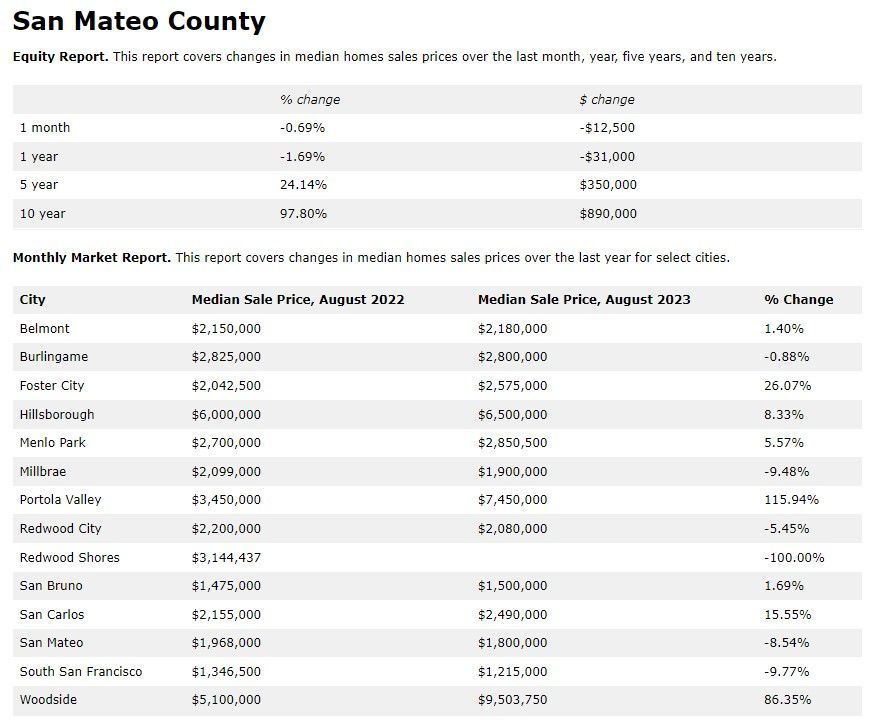

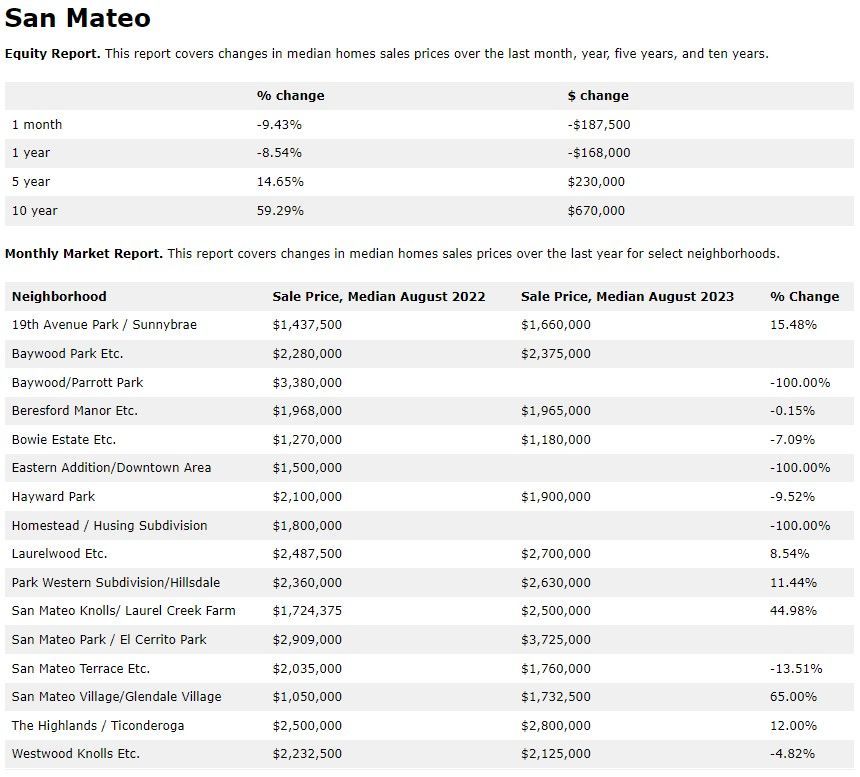

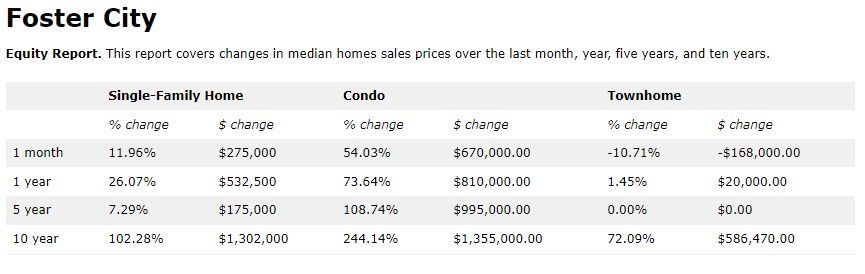

September 2023 Market Update and Equity Report